Monday, December 29, 2014

New Year’s Resolution - Avoid Accounting Regrets

One thing that I hear a lot from clients is that they don’t really know how to separate their business accounts from their personal accounts. This can make end of the year accounting a pain, not just for your accountant but for your business too.

As a New Year’s resolution you should consider paying yourself a salary if you’re self employed. I know this may sound a little bit weird since the money comes into a business that you own, so it makes sense to just use the money of the business to cover any expenses, right? Well the problem with that is that the IRS does not really see it that way. A business and an individual are two separate entities, this of course depends on how your business is setup but most businesses including LLC’s will benefit from keeping separate finances.

What you may not realize is that this will make it easier for you to track profit and loss. For example, if you’re paying yourself a consistent salary, then you’ll know exactly how much of a profit is left every month from the incoming transactions that a business has. There are many benefits from doing this but a lot of small business owners don’t realize that they should and probably have to do this to run a more efficient business.

On the flip side, if you pay yourself a salary you know how much money you can spend every month and budget accordingly. Business owners face the additional challenges of not having a steady paycheck, this can be especially difficult for those who have grown accustomed to having a job working for someone else. Knowing how much money you are paying your employees from a business stand point is important, and you should consider yourself an employee of your company.

Setting up a salary for yourself should not be so difficult, just look at your bank statements from previous months and approximate how much net income you’ve accrued constantly every month. Make sure to leave some buffer for unexpected expenses but at the same time make sure you’re being compensated fairly to avoid dipping back into the business account.

This New Year, make a resolution of being a better business by avoiding a whole year of accounting regrets, you'll be glad you did come tax season.

Tuesday, December 23, 2014

Christmas Bonuses and Uncle Sam

Thinking about giving an employee a Christmas bonus? That’s a wonderful idea! However, how will this really affect the way you do taxes this year?

IRS rules indicated that you’re required to withhold 25%-28% of their total bonus if it’s done separately. If the payment is done with their regular wages, then just withhold the percentage amount that you would regularly withhold from them. This is a very simplified version of the IRS tax law when it comes to bonuses, not only Christmas bonuses.

One thing to consider is that it is still money being paid to your employee, so no matter what, there needs to be a certain amount of taxes withheld. What you need to take away from is that if you don’t withhold taxes on your employees earnings then that money could be coming out of your company’s pockets and just never good.

The easiest way to do bonuses may be to pay the bonus alongside with their regular earnings, you don’t have to separate the items as an itemized deduction. This way your employee knows that they are getting a bonus since their pay will be elevated from what it usually is, also understanding that they have to be taxed on it. Doing it separately may come off as a double taxation since they are being taxed separately on the bonus.

For more information about Bonuses and Taxes, refer back to the IRS and their guidelines by visiting the following link.

Merry Christmas to all!

Thursday, December 18, 2014

Christmas Came Early - Know Your Tax Return Today!

Most people have a steady paycheck that they rely on, this can be true for many people along many different industries. A good tip that I offer my clients is to look to the past to know what will happen in the future. Taxes don’t really change much so as long as you have a consistent paycheck and your deductions are the same as last year’s then you should have a pretty good idea of what your tax return is going to be next year.

Have things changed since last year? Did you make any significant lifestyle changes such as: getting married, buying a house, retirement, new employment? If the answer is yes to any of those questions, then your taxes will be probably much different and you’ll need someone to help you ensure you are getting all the deductions needed.

Most simple taxes can be done and filed on your own, however if you have one of these big changes happening in your life you may to make sure that you have a tax accountant or an expert to ensure that you get the maximum deductions. Some people like to think that they can take shortcuts and save money by doing it themselves, however - hiring an expert can save you more. Sometimes covering way more, typically taking care of the fee you’re paying a tax consultant and also a bigger return.

Thursday, December 11, 2014

Give A Little, Get A Little

As the end of the year approaches and we are in mid-holiday season, we may be in the giving spirit and even though we typically do this as a selfless act, it doesn’t mean we can’t benefit a little from it. Picking a charity and donating money or physical goods is always a great idea, however it may be smart to pick a charity that will provide a tax write off. This will be especially useful if this year has been a particularly good one for you or your business and you have a little bit to give away.

Charity Navigator shares some really great pointers when it comes to Tax Benefits to Giving:

- A gift to a qualified charitable organization may entitle you to a charitable contribution deduction against your income tax if you itemize deductions.

- A contribution to a qualified charity is deductible in the year in which it is paid.

- Most, but not all, charitable organizations qualify for a charitable contribution deduction.

- There are limits to how much you can deduct, but they're very high.

- Rules exist for non-cash donations.

- Remember to document.

Not sure if the organization that you’re donating to is eligible? Here is a list of the places that may get you a tax deduction!

- Churches and other religious organizations;

- Tax exempt educational organizations;

- Tax exempt hospitals and certain medical research organizations;

- A government unit, such as a state or a political subdivision of a state;

- Publicly supported organizations such as a community chest;

- Certain private foundations that distribute all contributions they receive to public charities within two-and-a-half months after the end of the foundation's fiscal year;

- A private operating foundation which pools all of its donations in a common fund;

- Certain membership organizations that rely on the general public for more than a third of their contributions.

We’re always on the lookout for ways to improve the quality of life or friends and customers, but if you have any additional questions make sure to get in touch with Accounting Works!

If you’d like to read the full article by Charity Navigator click here

Tuesday, December 9, 2014

Accounting for the New Year

It’s the holiday season and everyone seems to be preoccupied with holiday parties, shopping and merriment all around; this is all great and I am probably one of the people that loves this season more than anyone else. However, tax season is not far from now, only a couple of months away if you really think about it. As a business owner or even as an individual how are your finances right now? Do you know where you stand as far as profits and losses for the year?

These are questions that you should be asking yourself right now, not next year. Once the fiscal year closes, it may be too hard to get tax write offs by making business related investments. If you have employees, you should make sure that you have all your numbers in order because you’ll be providing them with the right tax documentation so they can file in a timely manner. This is something that you should not be left as a last minute task, this needs to be present on your mind right now.

Zoho Books offers a great little cheat sheet for those who may need a little bit of a reminder on the things you’ll need to do before the year closes:

- Reconcile your bank accounts

- Complete your invoicing

- Record all your supplier bills

- Write off bad debts

- Get to the bottom and look for outliers

- Record your depreciation

- Handle prepaid expenses

- Close out the owner’s draw

- Get started with 1099s now

I know getting a lot of these things done before the end of the year can be a little bit overwhelming with the holidays being right around the corner but trust me on this one, you’ll be very happy that you got these done once tax season comes around.

To read the full article provided by Zoho Books, click here.

Monday, December 1, 2014

Saving for Retirement - A Guideline

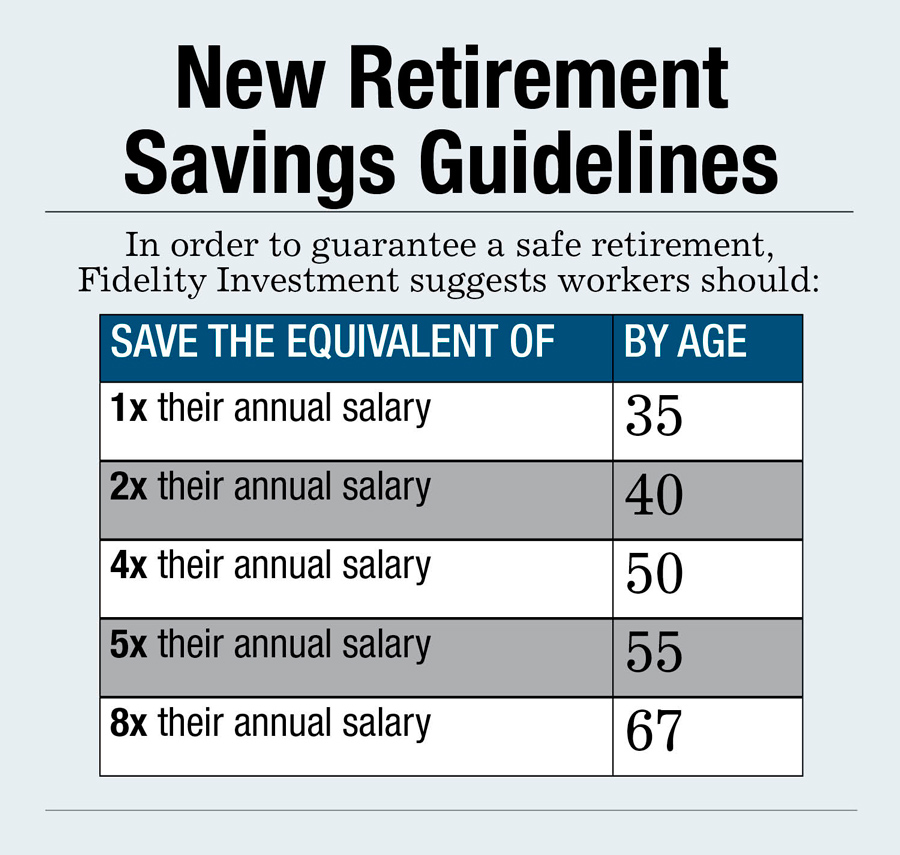

One of the questions that comes to mind when dealing with clients is retirement. It doesn’t matter whether you are self-employed, work for someone or have your own business; you should know how much money you will need for your retirement. Most people’s long term goal is not to retire when they are older but instead to retire at a young age.

Most people will retire around the age of 65-67 so we will use that marker to explain how much money you should have saved by that time.

We found a very useful graph from BenefitsPro that details some minimum mile marks for retirement based on one’s age.

In order for this logic to make sense the following financial assumptions are being made:

- Retirement age of 67

- Living until the age of 92

- 3% employer contribution, which would have to be adjusted if you’re self employed or own your own business

- 5.5% average annual portfolio growth rate

This is by no means an absolute saving solution for everyone because each person’s lifestyle varies greatly, but instead it should be used as a way to remind yourself whether you are on track to retirement.

As always, we’re available for clients and anyone who has questions on how to run your finances as efficiently as possible whether you are a big or small business.

-Stephen

(804) 915-7040

Friday, November 28, 2014

Black Friday & Tax Deductions for Your Business

Black Friday is here, and with it a very crazy shopping season. You may be spending quite a bit of money on different gifts but one of the biggest selling categories during this season is electronic devices such as computers, tablets and smartphones.

When you are making your purchases this season, think of what are some of the things you could purchase for your office or work. Big ticket items like electronics, sometimes cost hundreds of dollars and could hold a tax write off. However, you need to be careful if you use these items for personal use since this could potentially get you in trouble with the IRS if you claim them as a deduction.

We found an excellent article by Entrepreneur magazine that details what consists personal use since this can sometimes be a gray area.

Some of the highlights from the article include:

"Tax Write-Off: Cell Phone Bill

If you use a cell phone as part of your business, this could be a big deduction for you. So don't make the mistake of mixing business with pleasure by sneaking too many personal calls onto your cell phone bill.

* Expert Opinion: "Because of the way a cell phone can be used, it's come under scrutiny, so people need to keep good records and keep their actual telephone bill so they can demonstrate that a majority of the calls were business calls,"

* How to Do It Right: Take a look at your cell phone bill to make sure you receive an itemized report. Because cell phones are considered listed property, you need to keep detailed records of their use. In the case of a land line, it's a good idea to have a separate phone number for your business since the IRS won't let you allocate the cost of a single phone in your home to your home office.

Tax Write-Off: Home Office Computer

It's not a good idea to mix your business world with your personal life. So experts recommend never using your home office computer for personal tasks if you can help it.

* Expert Opinion: "If this is the only computer in your house, you'll have to calculate the percentage of total time you use it for business purposes,"

* How to Do It Right: Ideally, your best option is to purchase a laptop and dedicate it to being your personal computer. This way you can avoid any messy situations come audit time."

In other words, it’s never really a good idea to mix personal use of electronics when it comes to taking them as a tax deduction, but if you choose to get something with the intention of using it exclusively for work then by all means we encourage you to save some money this Black Friday and hopefully get a nice deduction once tax time comes around.

For more tips and tricks don’t forget to visit

www.AccountingWorksSolutions.com

or give us a call at

(804) 915-7040

To read the full article from Entrepreneur Magazine click here

Thursday, November 27, 2014

Welcome to Accounting Works Solutions

Most of my clients come to me for accounting purposes and guidance, but what I do is so much more than that. I familiarize myself with current tax laws, manage payroll, expenses and income and finally and most importantly, I build relationships. I am no the kind of business manager that steps away from a client once we have an account, instead we build connections and friendships. I don’t do this because I have to but I do this because I like to.

This may sound a little silly to you but I actually really love what I do, otherwise I wouldn’t be doing it. It brings me joy to make my clients life easier and make a positive difference in their company. I’ve learned so much doing what I do, that the next logical step for me was to share my knowledge with clients, friends and well anyone who is willing to read and educate themselves.

Accounting Works Solutions has worked very hard to make itself a successful business and I have such an amazing team behind me that it was almost impossible to fail, however as any business owner knows it’s still hard out there. So, I would like to offer my knowledge on best accounting practices, tips & tricks and just general updates so you can keep yourself in the loop of the latest trends and news when it comes to managing your business efficiently. As always we are here for you in case you ever have a question or need guidance, I hope you all enjoy our blog!

-Stephen

(804) 915-7040

Subscribe to:

Posts (Atom)