Everyone finally gets to take a moment to catch their breath after all the preparation they put into (or paid for) preparing their tax return. Finalizing the paperwork is both scary and relieving. But now that it’s over, what to do next? Just sit around for another 12 months until its time to start scrambling forms together again? No. Whether you are stressed about your tax liability or wondering what to do with that large sum of money, here are 5 things you can do to prepare for next year.

Refinancing

The Real Estate industry is all abuzz about how rates are still low into 2016. Remember though, a financial move that could reduce your payments or interest affects your tax liability at the end of the year. Reducing your interest rate reduces your itemized deductions, this could lead to a larger amount owed to Uncle Sam come next April 18. If you do some preemptive accounting, you can suitably tailor your withholdings or estimated tax payments throughout the year. Avoiding that jaw dropping liability takes a little more planning than crossing your fingers and hoping for the best.

Installments

If your tax bill is too large for you to be able to pay it all in one lump sum, you can request an installment agreement or payment plan. If you’re unable to pay your tax bill because of a singular event, filling out the proper forms should be enough. If you often find yourself falling short of your tax bill, it’s time to start thinking of increasing your estimated payments or withholdings. The IRS has been willing to combine previous installment plans with new ones, but the third time is not the charm in this case. To read about these plans visit http://www.irs.gov/Individuals/Payment-Plans-Installment-Agreements.

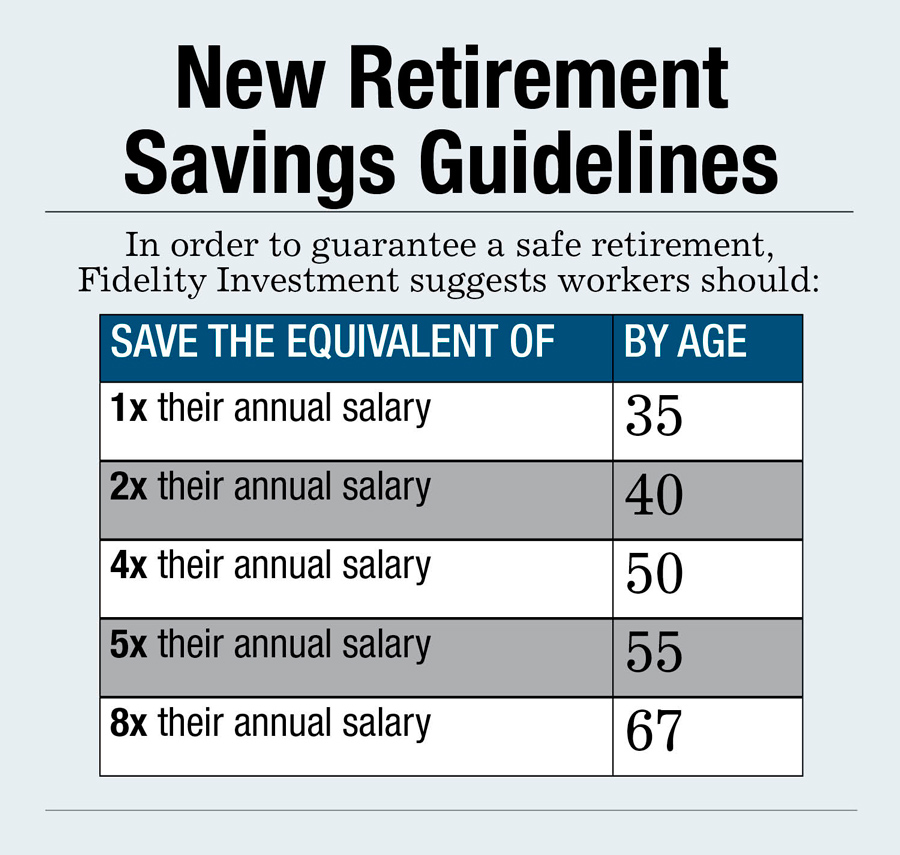

Secure Your Income for Retirement

Why not make the maximum contribution to your retirement fund. Whichever works best for you, either a traditional IRA or a Roth IRA, you’ll save money in taxes by allocating the funds to your retirement. A Health Savings Account (HSA) is also a savvy way to increase your deductions and put your hard earned money to work for you.

Unintended Savings

Keep saving that big return! Uncle Sam held on to it for you all year, if you can live without it, a big return can be good for putting away in your emergency fund, college savings for your child or a large home repair you know is coming down the road.

Unemployment

Unfortunately, if you’re collecting unemployment checks, you still have to pay taxes on that income. You can request federal withholding from these checks to cover that amount.

As long as you do a little preparation throughout the year, paying taxes won’t be as much of a burden come April. Tax laws are ever-changing, so being up to date on what’s relevant this year will help you plan according to their benefits or disadvantages.