Most people will retire around the age of 65-67 so we will use that marker to explain how much money you should have saved by that time.

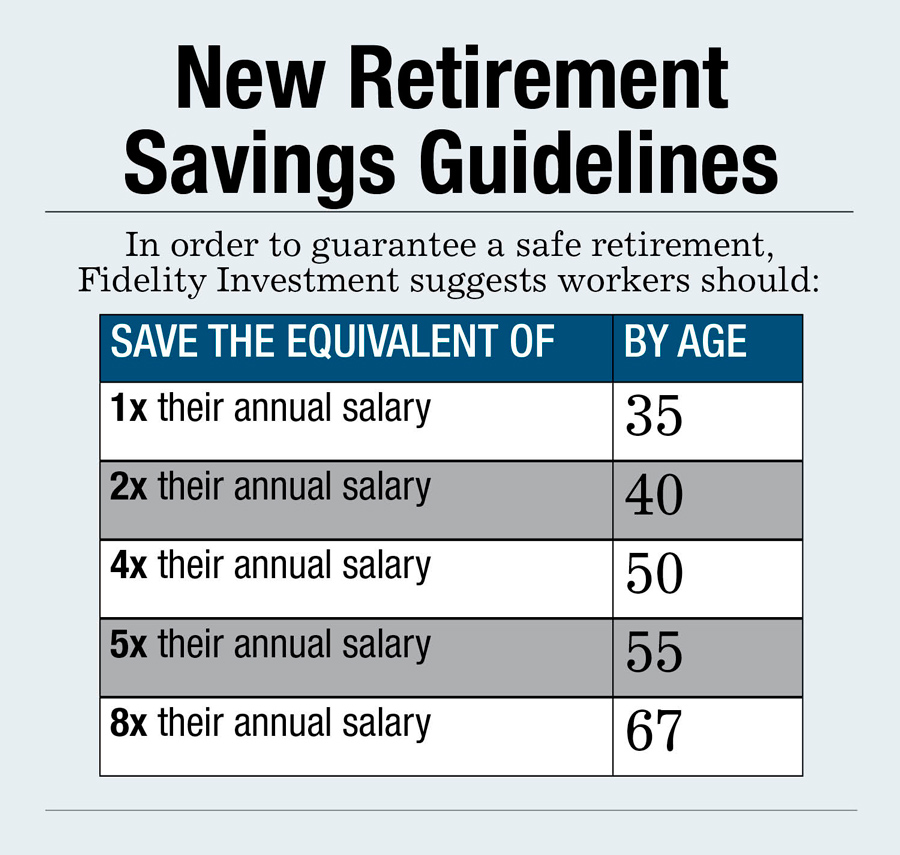

We found a very useful graph from BenefitsPro that details some minimum mile marks for retirement based on one’s age.

In order for this logic to make sense the following financial assumptions are being made:

- Retirement age of 67

- Living until the age of 92

- 3% employer contribution, which would have to be adjusted if you’re self employed or own your own business

- 5.5% average annual portfolio growth rate

This is by no means an absolute saving solution for everyone because each person’s lifestyle varies greatly, but instead it should be used as a way to remind yourself whether you are on track to retirement.

As always, we’re available for clients and anyone who has questions on how to run your finances as efficiently as possible whether you are a big or small business.

-Stephen

(804) 915-7040

No comments:

Post a Comment