Showing posts with label accountants in richmond. Show all posts

Showing posts with label accountants in richmond. Show all posts

Wednesday, July 20, 2016

Move Update for Our Clients

We’ve moved!

If you haven’t heard by now, we made a big move last week! It has been an exhausting process but we believe this new location will better serve our customers!

However, this move has not been without some minor issues. We’re still waiting for our internet to be fully operational in the office so in the meantime we have maintained our servers offsite. As a byproduct of this particular issue, we experienced some email interruption last week, this has been corrected and we don’t expect this issue to arise again. If you have emailed us within the last week or so and have not gotten a response from us - don’t be alarmed! We weren’t ignoring you, we just may not have gotten it. We encourage you to email us again so we can promptly get back to you.

At this time, we have limited availability for appointments and expect to be fully functional on Tuesday, June 26th. If you are one of our payroll customers, don’t worry, payroll services have not been affected by our move.

To all our other customers, we appreciate your patience in this matter and please, if you have a time sensitive issue that needs to be resolved right away, don’t hesitate in calling us!

We will keep you updated throughout our transition to our new location so keep an eye out for any email updates that may come your way!

Thank you, we appreciate your continued business.

- Stephen Fishel

You can now find us at

122 Granite Ave

Richmond, VA 23226

Monday, May 11, 2015

What Does Stephen Do After Tax Season? (The Four Things An Accountant Does During Off Season)

What I personally like to do, is lay back on some tropical island, order myself a Mai Tai and relax until about February when I get all the frantic emails and phone calls. JUST KIDDING!!! While I do like to plan a little getaway after the stress of tax season, there’s still work to be done throughout the year. So what do I do? I’ll tell you...

Financial Consulting and (light) Advising

If I had to name at least one of my skills, it would be analyzing cost efficiency. I can help you increase your company’s profits by seeing where some spending may be extraneous, or I can help you with ways to decrease your tax liability. Believe me, these plans cannot just be implemented overnight. Having a tax strategy throughout the calendar year, before April 15, will save you more money than last minute deductions. Not to mention monthly, weekly, if not daily general accounting, bookkeeping and payroll tasks. If you have me doing these things throughout the year, it is easy for me to give you quarterly updates on your company’s finances.

Handle Extensions

While the pressure gauge drops after April 15, that doesn’t mean the work is over. Often I recommend filing extensions for those who need more time to organize their financial documents. While you still need to estimate and pay the appropriate amount by April 15, the extension gives people more time to play catch up in order to avoid filing for additional extensions.

Off Season Assistance

Those who didn’t file tax returns for previous years often seek my help during off-season hours. For any businesses who are dealing with audits, I may be asked to prepare various financial statements or compilation reports.

Workshops and Continuing Education

In the off season, I seek opportunities to continue my education and do any training or seminars on tax strategy and preparedness. In fact, I did a Lunch and Learn this past March with the Richmond Business Alliance. I'm already looking to do more in the near future!

While it’s true that my mailbox is full during those busy months of filing, my plate is still full throughout the year. However, if you have any tax questions, it is more likely that you can reach me more promptly before the hysteria begins.

Thursday, April 30, 2015

Keep Your Options Open by Planning Ahead

Okay, you’ve heard me say it before, but getting ready for next tax season NOW, is imperative. By this time you’ve already gotten past the elation of a sizable return or the drudgery of paying that surprise lump sum. So, begin to direct your attention to being the best proactive business owner you possibly can be.

Purchasing sophisticated accounting software to help keep you organized does you no good if you’re scrambling to enter your shoebox of receipts at the last minute. Keeping your records up to date not only helps you rest easier at night, it helps keep an eye on the vitals of your business, which also helps you rest easier. It’s a vicious cycle. Doing this will help you make decisions in real time, rather than hindsight. Updating your books with regularity, at least once a week, is like going to the gym. You know it’s a good idea, but you put it off until eventually the paperwork (or pounds) pile up, then it seems an even more unsurmountable task. Think of it as part of your overall financial health and just DO IT for the longevity of your business.

To Do:

- Document invoices, bank statements and receipts. Expenses for travel and entertainment are the most reviewed by the IRS so make an extra note on it’s business purpose and who attended the event.

- Always have an updated record of accounts receivable and accounts payable.

- A Form 1099 must be filed for any contractor you pay over $600 in a year. This needs to be done in January, not at the last minute. You should be able to predict by June if you will pay a subcontractor more than $600 by the end of the year. You need their current address, tax ID number, and proof that they are a subcontractor to your business and not an employee. This includes invoices or business cards.

- If you are the subcontractor paid more than $600 in a year, be sure to include that amount in your taxable income. June is also a good milestone month to consider year-end bonuses or seasonal hires as they can both affect your tax liability.

- If you are audited, you are responsible for at least 3 years of previous tax and income records. If they believe fraud is involved, that time period could be extended to 6 years.

- Check for accuracy; reconcile bank accounts and income statements.

Remember, having tax questions and asking about options in February is not really setting yourself up for success. Last minute scrambles to save severely limit your options. Ask your accountant about some of the things you can do to reduce your tax bill. If it looks like your revenue is sky-rocketing, it might be a good time to purchase that large piece of equipment you’ve been wanting, therefore decreasing your income. Also, keeping tabs throughout the year will help your liability be less of a surprise when the time comes, meaning you can accurately predict how much money you need to set aside.

Tuesday, April 28, 2015

5 Apps to Bolster Productivity

(Image Courtesy of Venmo)

There are many arguments back and forth about technology in the workplace. Some say it’s a distraction, others a new way of doing business. It’s no longer a faux pas to have your phone out at a meeting. Updating calendars to quickly taking notes, we use our phones for everything. Why not use the technology to our advantage by having a customized set of tools at our fingertips!

1. Venmo— If you need to make payments on the go, this app is for you! There are no fees and no forms. It’s a fast way to split lunch meetings, cover client’s travel, etc. This is a top notch alternative to PayPal.

2. TripIt— An organizational tool that puts all of your travel bookings in one app, it also helps keep track of expenses for tax filing as well!

3. Contactually— This app helps you manage existing contacts and leads. It helps you maintain relationships with them through daily follow-up reminders as well as track progress with weekly statistics. Set up due dates within the app, or notifications for any contact leads. This app really helps you get the most out of your connections.

4. Invoice2Go— End the moments of headslapping when you forget to invoice a customer! Do it on the go with this app that sends professional looking invoices, fast. Don’t let forgotten amounts due slip through the cracks.

5. EchoSign— You don’t have to wait for a scanner anymore. Adobe, using pdf technology, sends esignatures on important documents through your mobile device or tablet. These documents are stored using cloud technology and speeds up the pace of your day to day business.

Used wisely, technology can help any entrepreneur be a resourceful powerhouse. These apps hopefully simplify the process and paperwork of daily business so you can focus on your product and productivity.

Monday, April 13, 2015

Starting A New Business? Beware of Any Old Business Debts

Making the move from a sole proprietorship or partnership to an LLC or Corporation is a smart business move. It protects your personal assets from being threatened against business debts. Unfortunately, any old business debts accrued before the conversion means your personal assets can still be threatened from that time. Often if you don’t pay off your old debts before forming the new corporation or LLC, or pay them down in a timely fashion after the conversion, creditors could potentially go after your newly formed business to pay off your old debts.

What’s in a name?

Being adamant about only using your new corporate or LLC name for business transactions is essential. Sign all contracts and checks under your new name. In order to fully establish all that’s required to retain the benefits of LLC status, call the bank where your business holds an account to learn exactly how to endorse your checks. It is usually using the company’s name, or your current position.

Its also a very crucial step to change your letterhead, any marketing materials, business licenses and permits, etc. to clearly state your new status.

Notify Clients and Suppliers.

As soon as the conversion to a corporation or LLC is completed, your new priority is to send a notification letter to your customers, suppliers and clients notifying them of your new business structure. Make note in the letter that business conducted moving forward should be done using your new name, which can be the same as your old, just tacking “LLC" or “Inc." to the end.

Formalities, please.

It is important now to distinguish your new corporation or LLC as a separate entity from you. One of the main guidelines is to have regular meetings as per your structure’s bylaws or operating agreement and to document these meetings. Following the formalities of your business operation deters creditors from potentially claiming your new structure as a sham to avoid them.

Build your Business’s Credit

It may be hard to get a credit line or take a loan out from a bank without making a personal guarantee, which is something you want to avoid. Unless you can prove to the bank that your cooperation or LLC has enough assets to cover the debt, they may want to have your personal signature. Just as you would work to build your personal credit, you can establish your corporation’s or LLC’s credit. You can either take out a couple business credit cards, or establish a trade lines of credit with your suppliers. If a vendor won’t work with you without a personal guarantee, you can usually find someone else who will, especially if you can offer an upfront payment for the first few transactions.

There are a few ins and outs to operating as a corporate or LLC business structure. As long as you are aware of the regulations and operate accordingly, you can enjoy the benefits of a corporate or LLC structure and your personal assets will remain protected.

Monday, April 6, 2015

3 Things To Remember When Filing An Extension

April 15 is fast approaching and some might not be ready to file yet. Fear not, anyone can apply for an extension. Yes, even you. There are a three things to know first before filing for an extension.

1. Form 4868 is what you need to file in lieu of your Federal Income Tax Return. You can file it by mail or electronically, as long as it’s in by April 15 you will have an automatic 6 month extension to file.

2. Remember that this form is just an extension to file, not an extension to pay taxes. You must have an estimate of the amount you owe and send it when filing for an extension to avoid any late fees or penalties. Any underpayment of taxes not paid by April 15 is subject to late fees and interest.

3. The purpose of this form isn’t just to procrastinate until October. The time is meant to allow for complete and accurate filing without assessing a late filing penalty. The extra time granted is usually used to seek professional advice about your financial situation.

There are many benefits to requesting an extension to file your income taxes. It’s a great way to avoid the busy rush of tax season and your tax professional will more likely have time after mid-April. The most important thing to remember is that it’s an extension of time to file your return, not to pay taxes due.

Tuesday, March 31, 2015

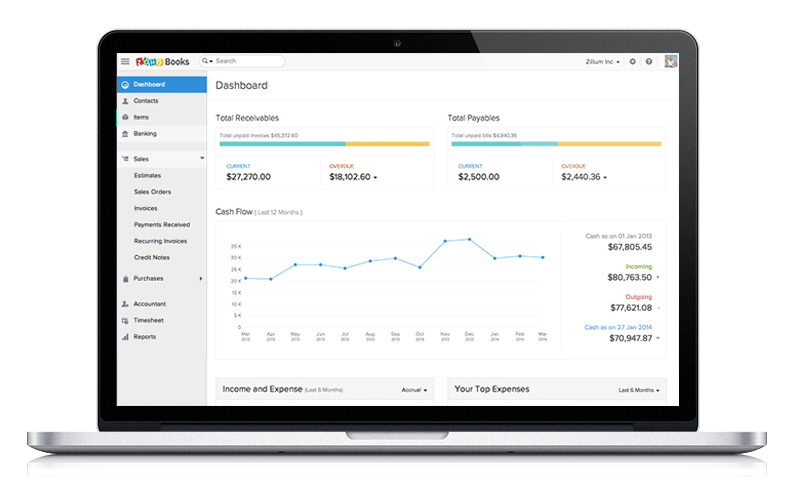

MUSTS for Accounting Software

So you have made the decision to purchase accounting software for your small business. Congratulations! That means you’re becoming successful enough to make such an investment and counting on future success. You want to get on top of organizing your finances so your business has room to grow. Now, where to begin when choosing WHICH software option is right for you. The top two priorities when deciding which software is right for you are ease of use, and time savings. This can encompass different things for different businesses, so here are a few guidelines when considering which software options to purchase.

1. Basic Accounting Functions

Tasks like invoicing are essential, basic functions to bring money into your business. Most businesses need an interface to create invoices either through email or by post. Being able to tally income and track expenses as well as generating reports based on that information is valuable to your company and helps you make more informed decisions. Another basic, but key function would be client and vendor administration. Being able to pull up the histories between you and your clients with a click of a button means ease of use and less filing cabinets.

2. Automation

If your calendar isn’t flooded with day to day tasks and making personal calls to your clients is something you pride yourself in, automation might not be a necessity. However, if you have multiple projects happening at once, automation of invoicing, late notices, recurring payments, deposits, etc. is a godsend. Keep your credit on track by paying your bills automatically. Knowing when to cut off services by keeping track of who hasn’t paid yet can be a money and time saver. Automation is essential to time-management for any business.

3. Tax Preparation

This feature makes you and your accountant’s life WAY easier at the end of the year. You can automate tax calculations at different tax rates and easily transfer data to your accountant. Having an expense report, or any large purchase deductions at the ready equals time savings not tallying up your shoebox of receipts at the end of the year.

These are the major three you want to consider when making an accounting software purchase. Lots of programs offer free trials, so you have a chance to try out the interface. If your business has already blossomed, there are a few more features to assess.

4. Quotes and Estimates

Some software allows you to generate templates on which to create quotes for potential clients, then automatically convert them to invoices.

5. Payroll Processing

Calculating time sheets is time consuming. With a payroll processing feature you can calculate hours, rate of pay and print checks.

6. Third-party and mobile input.

If you want to be able to access and input data from anywhere you are, this is an important feature. Automatically input data from your phone using a mobile version of your software or integrating a third party app such as a mileage tracker or device such as a POS system.

There are multiple solutions for your business accounting needs, the trick is finding the option that works for you. Remember, its all about ease of use and time saving. The software with the most bells and whistles can sometimes take up more of your time figuring out. Pick the software within the scope of your business and it is likely to be as straighfoward as you.

Wednesday, March 18, 2015

The Risks of Missing Tax Deadlines

Haven’t done your taxes yet? You’re not the only one, but what happens if you miss a tax deadline? Do you go to jail? Even though the IRS can be one of the scarier branches of the government, it doesn’t work quite like that and there is some flexibility on how and when you file.

Can’t make the deadline because of an extreme circumstance? You can file an extension to file your taxes later on, however you need to pay at least 90% of your tax bill before April 16th, otherwise you will be hit with a late payment penalty. In other words, you still need to calculate how much you owe in taxes even when you file a tax extension.

Filing a tax extension doesn’t necessarily mean you get a free pass to not pay them until you feel like it, like I said before, you need to pay the majority of it off before April 16th or you’ll start accruing interest charges. What you owe will accrue interest, starting at .5% of your bill the first day that you’re late. Also, there will be a 3% compounding interest fee on the unpaid balance.

So let’s say you don’t file you taxes and you don’t file an extension, you could be facing a penalty of 5% to 25% of your tax bill. If you wait more than 60 days you’ll be charged $135 or 100% of the taxes you owe, whichever is less. This only applies when you owe money, if you don’t you don’t get a penalty at all but this should not serve as encouragement to miss deadlines because if you wait too long you may not qualify for a refund at all, more on that later.

People who do file their taxes but didn’t pay for them by the deadline also get penalized but not quite as harshly as those who have missed these deadlines. The percentage added on is .25% for outstanding balances as long as you have a payment agreement in place which can cost anywhere between $52-$105 to apply for.

What happens when you don’t file or pay taxes? This is the LAST scenario that you want to be in but if this ends up happening to you the IRS will take control of the situation. They'll calculate what you owe and you’ll have all of the fees mentioned above for not filing and not paying on time. If the government owes you taxes and you have waited more than three years, you won’t get your money back so time is always of the essence when dealing with the IRS. In very extreme situations you may qualify for a Offer in Compromise which is basically a reduced tax bill, but you have to prove that you are going through extreme financial hardship to qualify.

When you can’t come to an agreement with the IRS they can actually levy a federal tax lien on your finances which can mess up your credit in more ways than one. You don’t want to be in this situation EVER because this means they could take the taxes that you owe from your Bank Account, Retirement, Social Security and even your wages. Being proactive about filing taxes even if you’re filing late is better than getting to this point with the IRS. As an accountant and someone who deals with helping with people with their taxes, I can tell you that you need to be proactive about your taxes rather than just letting it go for a few years and have to deal with garnished wages.

Wednesday, March 11, 2015

March Tax Deadlines

For those small corporations, March 16th is an important date to remember. Here are a couple things you need to have your tax filings up to date for the month of March.

March 16

Form 1120— File and pay a 2014 income calendar year income tax return.

Form 7004— It is an Application for Automatic Extension of Time To File Certain Business Income Tax, Information and Other Returns. This form give you a 6 month extension to file, make sure you deposit an estimated amount of what you owe.

Form 2553— S Corporation Election. Its the form small businesses need to elect themselves to be treated as S Corporations beginning in calendar year 2015. If this form is filed late, treatment as an S corp won’t begin until calendar year 2016.

Form 1120S— S Corporations need to file and pay a 2014 calendar year income tax return. They also must distribute the schedule K1 (1120S) to each shareholder.

Form 1065B— Electing Large Partnerships. Provide each partner with a schedule K1 (1065B). This due date still applies even if the partnership is filing for an extension (Form 7004).

March 31

If you have missed the March 2 deadline, all forms below must be filed electronically by March 31.

1097, 1098, 1099, 3921, 3922, W-2G

See publication 1220 for filing these forms electronically.

Labels:

accountants in richmond,

deadlines for taxes,

filing business taxes,

filing corporate taxes,

form 1120,

form 2553,

form 7004,

march tax deadlines,

richmond taxes,

Tax March 16

Location:

Richmond, VA, USA

Tuesday, March 10, 2015

Taxes and S-Corps

S Corporations have been popularized as a way to structure a small business because of the many advantages it once held to avoid certain types of taxes at the end of the year. The shareholder-employees of a pass-through entity, that defines an S corporation, could once navigate the vague terminology written in the tax law to lessen their payroll tax liability as well as dodge the self-employment tax. In previous years minimizing one’s compensation in favor of shareholder distributions was considered savvy in order to minimize payroll taxes. However, in the past few years, tax court precedents have been set that more clearly defines what reasonable compensation means, eliminating the ability to shirk tax liability through the shelter of an S corp business structure.

An advantage of structuring your business as an S Corporation is not having to pay entity-level tax on the company's taxable income. Attributes and income are instead distributed among the shareholders. Those individuals then pay personal income taxes on these reported items. This sheds light on the tax advantage over sole proprietorships, partnerships and LLCs. Unallocated shares of the corporation’s income aren’t treated as self-employment income. The other business structures would be liable for paying self-employment taxes. Employers and employees currently have to split 12.4% social security tax up a certain amount and 2.9% in medicare on all wages, without limitation. Self-Employed individuals are responsible for the full amount. S Corporation income is not at risk of the self-employment tax. There is also great incentive for shareholders to prefer distributions over compensation, as distributions are not held to payroll taxes, either.

However, no longer can a shareholder-employee evade payroll taxes by eschewing “reasonable” compensation. Until recently it was left unclear what exactly reasonable meant and there was little guidance in how to prescribe a shareholder-employee’s salary. Many methods have been used, some avoiding a salary in favor of distributions entirely, others have opted to disguise compensation as independent contractor fees and most popularly, under-compensation. The IRS is now aware of these liability evading methods and have more clearly set compensation guidelines.

In three court rulings over the past three years, the IRS has been building road blocks for those S Corporations trying to eschew their tax responsibility in these ways. In one case, it was ruled that shareholders/employees who provide eminent services for a company may not take distributions in place of compensation. In another case, a shareholder’s compensation was way below the industry average especially when taking into consideration his years of experience and level of education. Independent contractor fees have been annexed from creative compensation options as well. A court did rule, however, against the IRS in one of these claims dealing with S Corporations in which a shareholder took distributions in lieu of salary, but was able to justify it because of his minimal contribution to the company.

Three determining factors in reasonable compensation has come out of these various rulings. First is the performance of the employee; how much they contribute to the revenue of their business. It is no mystery why professional fields such as law, accounting and real estate have set these precedents, because company profit is highly based on personal performance. Salary comparisons within professional fields. Based on region and firm size, a shareholder/employee should be making within a certain pay scale. That pay scale can also be determined by company conditions. If the business has excess capital not being used for expansion or reinvestment, that is a red-flag for the IRS. Other company’s not in danger of this scrutiny would be where profit is based on capital and assets like in manufacturing and distributing. In this arena, individual performance does not necessarily effect revenue.

S corporations still hold their lustre as a tax saving business structure, it is just important to follow these guidelines in determining compensation so as to not raise any red flags. There are also strategies in avoiding a large tax bill at the end of the year. To be continued...

Friday, March 6, 2015

Recap: Prepping for Taxes Lunch & Learn

The Lunch and Learn yesterday was quite a success. Some of the topics I went over, ironically one of them being how to pay your accountant less, were met with helpful questions and led to the group discussion “learning” portion of the lunch. I’d like to go over some of the points I made just to recap and not leave out anyone that couldn’t make it.

How Prepping Can Save You Accountant Fees:

This seems like a self-defeating point to make, but in fact it’s the opposite. Most of our workload is done just a few months out of the year and the way you pay me less is by having your documents organized. By saving me time, it saves you money. Using expense and mileage apps organizes the information that you need and if you’re averse to technology, go through your shoebox of receipts ahead of time. Organizing the information you gather from your documented expenses onto a sheet of paper that your accountant can decipher is very helpful. Save the documents for your records, all an accountant needs is the numbers.

Another way to save money is to get your documents in as early as you can. It’s not uncommon for accountants to charge more for their work if you really put them in a time crunch. This comes in handy in a couple ways, in fact. Preparing your tax return early doesn’t necessarily mean filing your taxes early. I recommend waiting until mid to late February to be able to adjust to any amendments that might be issued by then. Also, it is helpful if you plan on filing for an extension. You need to have a good estimate of your tax liability before filing for an extension and the best way to make that estimate is by preparing a tax return.

One more note on organization. If you’re self-employed, it is important to clearly separate your personal expenses from your business expenses for your accountant. Again, it is a time saver. Furthermore, separating your expenses by becoming a corporation or a limited liability company saves your personal finances from being encroached upon if your business is on the hook for any sum of money. Separating your finances also helps you claim the “reasonable compensation” you’ve paid yourself throughout the year. The format in which you do so depends on which business structure you choose.

Planning:

Plan for the self-employment tax. If you are a pass-through entity or a sole proprietor, I recommend deciding on a fixed percentage to withhold on your W-4 form to do this, especially if you estimate you’ll have a good business year. You can reduce your tax liability by keeping accurate records of your work mileage and expenses throughout the year. If you have a home office, you can reimburse yourself through the company for that space in your home. Another way to avoid that big bill you’re expecting by making scheduled payments, however, depending on your company’s financial status I don’t necessarily recommend doing it this way. Less funding is going to the IRS, which means less agents. I’ve personally known some scheduled tax payments to be lost, so again, I stress: document, document, document!

Make sure your financial planner and your accountant are in cahoots. The best way to achieve your financial goals is to make sure these two entities are talking with each other. It helps your accountant know how to file, how to better spread your finances throughout the year, etc. These two capacities, while very different, are complimentary to each other and can help you better if they’re working with each other.

Being Selective:

If you have any more than a W-2 form, I recommend seeking a professional tax-preparer. However we are not all equal. Seeking out an Enrolled Agent or a CPA is probably best for your business and tax liability. While a CPA can represent you in tax court, both enrolled agents and CPAs pass similar standard tests to assess their proficiency. Other tax preparers who are not held to these standards, simply have to file for a PTIN, a tax preparer identification number, annually in order to do your taxes. Interview your tax preparer and ask for their qualification and experience.

Thanks to all those that made yesterday’s Lunch and Learn a success! I enjoyed it. I’m glad both Pat and I had a chance to share our knowedge with local business owners during tax season. Hope it helped to get the most out of your return

Tuesday, March 3, 2015

Tax Time - Last Minute Considerations

When you’re running a business it’s hard to do it all. Filling your taxes in a timely manner can be difficult and if you’re a business owner this is especially true because you typically have a lot on your plate. The problem with waiting until the last minute to file your taxes is that you may miss some things that will work to your advantage. Here are some of the things you want to pay attention to when you’re filing this year:

Free Filing

If you made less that $57k in the past year, you are eligible to use free e-filing software. What’s great about this is that there is little to no out of pocket expense to you and it's typically self-explanatory. You get asked questions about your business and finances, and you fill out the form like you would any other questionnaire.

Start-Ups

Did you start your business last year? You qualify for a $5k deduction since starting a business is considered a capital expense. This may not apply to everyone but it definitely applies to some, and if you did start a new business last year, congrats! It’s not easy.

Education

Did you take a class or course to receive training to improve your business? If so, that also qualifies as a deduction. Things like seminars and conventions count too!

Driving

Mileage is one of the easiest deductions for you to qualify for. Whether it’s meeting clients, getting supplies or doing research around town, you can get a deduction for using your own vehicle to run your business. Most business owners have to do this at some point or another, just make sure that you keep track of your miles and maybe even use a helpful app to do it for you!

Working from home

Being your own boss is great, but if you also get to work a lot from home and have a dedicated space just for that, that also qualifies as a deduction. You do have to specify square footage but that shouldn’t take too long to figure out.

Insurance

There’s no one looking out for you but yourself when you’re self employed, this is why getting health insurance is on you. Not to worry though, IRS knows that this can be a costly expense on someone who has their own business and sometimes either offers assistance or a tax break to ensure you’re healthy enough to run your business.

Software and subscriptions

Quickbooks, Photoshop, Paypal - if you’re a business owner you may be familiar with some of the these software programs. Most of these require a monthly subscription which can end up costly hundreds of dollars a year, take this as a deduction also because it is considered a business expense.

Hotels and Meals

We never know where work will take us, but we do know that covering these expenses can get costly. That is why saving all your receipts for both meals and hotels is important. Most of these things, as long as they are a business expense, are also deductible.

Want to know more? Accounting works will be hosting a Lunch & Learn free to members of the Richmond Business Alliance 3.3.2015. Non-members can attend for $10.00. RSVP right here.

Official Event Name: Lunch & Learn - Tax Time Sponsored by Accounting Works & Pat McAleer, CFP®, ADPA® from Kasch, Levitch, McAleer & Associates

Thursday, February 19, 2015

Best Mileage Trackers for Keeping Up This Year (For iOS)

So it’s come time to do your taxes, and you realize how inaccurate, unused, sparse or missing your mileage data spreadsheet is. It is hard to paint a clear picture for work mileage deductions, or even compensation from an expense account if your record keeping is not complete. No one wants to lug around a ledger, or go back to the office after a business trip to record exactly how far you’ve gone. Help yourself and your accountant this year, by keeping up with your miles in the technology age. While apps don’t necessarily make your record keeping less boring, it certainly makes it more convenient. Here are a few reviews of the best apps available. Consider getting your money’s worth this year just with a few clicks at your fingertips.

Mileage Tracker +

$9.99

Previously Trip Cubby, Mileage Tracker + is just as praised. Easily log and store your trips by setting beginning and end destinations, this app will add up the miles for you. Frequently travelled routes can be saved for easy access at any time, and reports can even be exported within the app. You can track business miles and even count charity and medical miles as well. Mileage Tracker + uses current standard IRS rates.

Auto Miles

Free ($4.99)

Auto Miles does exactly what the title implies, it detects when you’re driving and starts keeping track. Every mile you travel will be stored in this app. If you have a personal trip you don’t want put on your expense report or claim, simply swipe and delete. The 5s version of the iPhone and up uses M7 or M8 motion technology to do this for spot on mileage. This app is free up to 100 miles before you have the option to upgrade to the full version for $4.99. Most businesses or individuals that need mileage apps usually log more than 100 miles, so its more of a free trial. You can export the data to a spreadsheet for your expense reports to your accountant or finance office. If you frequently forget to log your miles, this is a good app for you.

klicks

$2.99

If you need on the go tracking, like easy access to start logging after you’ve already started your journey, klicks is all about automatic input. Typing your end destination and choosing from options automatically provided in the search field, your current location is used as the starting point. Previously selecting your preferences in Settings, it will automatically record your round trip. Click to add the trip to your journey log and export it through email in a .csv file.

These top rated apps should get you revved up about staying organized this year for next tax season. Not only get the most out of your mileage, but have the records at your fingertips. You want to make sure you can store data from all your business trips, as well as have an easily exportable format for yourself and your accountant. You may also want to consider a maintenance feature within the app for vehicle upkeep. While this is by no means a comprehensive list, it should get you thinking about what will work best for you. Bon voyage!

(All apps available in the app store)

Tuesday, February 3, 2015

Streamlining Your Business

Congratulations! Your business has made it another year. Your effort was spent finding out what works, what doesn’t, what you can offer, what’s cost effective, how to handle bumps in the road, the right size staff for your budget and company, and the plethora of other things on your plate this past year. Now it’s tax season and you’re stressing about everything you didn’t keep up with, record and document. I’m sorry, its gonna be a doozy. However! And there is a however.... The Silver lining is another year’s experience. Whether that’s a tacky or blindly optimistic approach, now that you have the major kinks out of your plan and a few more things figured out, this year is the time to fine-tune your operation.

Start with the Basics

Assess your bank. One of the major things you have going for you as a small business owner is your cash. Many entrepreneurs and people in general don’t have a clue how much they’re paying in service charges to the bank every month and exactly what they’re paying for. Request an analysis statement that breaks down your generic monthly service charges. You can then decide whether or not you need them, and if you can reduce costs in this area and take your savings and cash flow to the next level. It might even be beneficial for you, if it’s within your budget, to request other services your bank may provide to keep your finances organized. However, if you have taken the step to have someone else do your accounting for you, those services may already be rendered by him or her. Banks are still business and don’t like losing clients, so small negotiations with your banker could have positive results.

Make a Comparison. It’s great that your company has grown and is continuing to, but do you know how your business stacks up to growth within the industry? Before you do a whole lot of legwork, your accountant most likely has all the industry statistics and data comparison points on file that a lot of entrepreneurs aren’t taking advantage of. Have these numbers available for your future strategy meetings and make your bench mark this year!

Automate It.

Be advanced. Do you have small bills that stack up every month? Instead of paying a $20 dollar monthly bill, pay $120 in advance for 6 months and save time paying all your little bills, not to mention saving money in stamps and accidental late fees! The little bit of effort has a big payoff in stress and time management. If your business has busy seasons and slow seasons, it’s a good idea to implement this tactic during the slow seasons when you have a little looser of a belt. That way it’s already taken care of when your belt tightens again.

Use your (other) brain. Most likely your phone is a priceless asset in time management and helping you keep track of your company day to day. What about month to month? Save yourself the stress of remembering dates and funds or late invoices. Do you have an accounting package that handles your bills? Automate the process. Your accounting software can generate invoices, send email alerts of late payment notices to your clients and handle electronic transfers (along with your bank).

Keep it on Schedule. Making a schedule for multiple employees can be a nightmare. Did you know there are software packages that make scheduling less of a headache? Asgard System's Time Tracker, TimeClock Scheduler and TimeCurve Scheduler among others, are a few software options that have to ability to track employee hours, alert you of any scheduling conflicts and even make payroll easier in some cases. Some of these websites offer free trials as well. You can spend more time building your clients than laboring over the schedule on a weekly basis.

Tuesday, January 13, 2015

Accurate Accounting And Its Importance

Tax law these days is getting increasingly complex. Knowing what qualifies for a tax break, questioning what you’re required to claim or not along with saving your receipts year round can be overwhelming. Recent rulings in federal courts have put the burden of proof more heavily on the taxpayer rather than paid tax preparers, which a staggering 50 percent of Americans rely upon when tax time comes. Whether it be e-filing at home or a larger firm, in the end the responsibility is still with the person who is filing.

In 2013, Federal Courts ruled that the IRS did not have the power to regulate paid tax preparers and this decision was upheld in appeals court last year. In response to this ruling, there has been new legislation introduced in the Senate to give the IRS and the Treasury Department said needed authority. The intent of this legislation is to protect tax payers from incompetent preparers by making enforceable standards to which they will be held. While CPAs, tax attorneys and Enrolled Agents are still under the IRS’s umbrella of regulation, this new legislation is aiming for those tax preparers who aren’t already registered. For now, the IRS is offering a voluntary program for continuing education and testing called the Annual Filing Season program.

There is some controversy over whether or not this will be good for the taxpayer. Some argue that making the IRS responsible for overseeing the very preparer who is trying to guard your money from the government seems as helpful as shooting yourself in the foot. In other cases, it is viewed as holding the preparer responsible for his or her job the way you would a contractor to build your home, there are rules you must be held accountable for. However, in both cases it is clear that the taxpayer must ultimately be the one protecting themselves. To stay organized throughout the year, spending a little extra money on a qualified accountant to keep track of yours can really pay off in the long run. Maximize what you save in paying taxes or maximize what your tax return may be, keep track of your dollar so you can be solid and assured when its time to file.

Click here for more information about the introduced legislation.

Monday, January 5, 2015

Business in 2015: Arm Yourself With the Right Tools for Tax Season

Being a small business owner usually means doing a lot of the work yourself, on top of everything taxes can be a handful! As long as you follow a few basic rules, you don’t have to sweat tax season at the last minute.

Get An Accountant.

When you first open your business or shortly after you can afford it, get one. They can set you up with a system to keep all of your records for the year, whether it be paper or an electronic filing system, having accurately dated information is very helpful. They’re very knowledgable and current with tax laws that may benefit your business with new tax breaks! Also, they can inform you about what filing system might be best suited for your small business; filing monthly, quarterly or just annually.

If you have employees, file the right forms.

Making sure you have all the right forms can protect you and your employee when tax season begins. Have your employees file a W-4, and you can immediately begin withholding wages for tax purposes. Contractors fill out a W-9.

Keep records, keep records, keep records. Did I mention, keep records?

You never know what may be deductible for the tax year. Keeping detailed income records is vital. Gross receipts, inventory, investment interest, etc. What also may prove helpful is keeping track of office expenses like rent, business vehicles, travel expenses even down to parking receipts. The list goes on, just think, if you’re doing something for your business like just running to the store for paper clips, write down your mileage, keep the receipt for the paperclips. Keeping track of employee payroll and contributions, legal fees and business insurance is also important.

Pay yourself.

Document how your salary is decided. In most cases it is not legal to pay yourself with the entirety of the profits. Pay yourself, and use the rest to increase your equity.

Finally, decide in advance how you want to prepare your taxes

You can use e-file or software, a CPA or a tax preparer, or do them yourself. Request all the tax forms months in advance. If you’re prepared, you can avoid incurring late fees.

As your business grows these things will become like second nature and keeping organized will seem like a synch. Dreaded tax season won’t seem so bad after all!

Subscribe to:

Posts (Atom)