So you have made the decision to purchase accounting software for your small business. Congratulations! That means you’re becoming successful enough to make such an investment and counting on future success. You want to get on top of organizing your finances so your business has room to grow. Now, where to begin when choosing WHICH software option is right for you. The top two priorities when deciding which software is right for you are ease of use, and time savings. This can encompass different things for different businesses, so here are a few guidelines when considering which software options to purchase.

1. Basic Accounting Functions

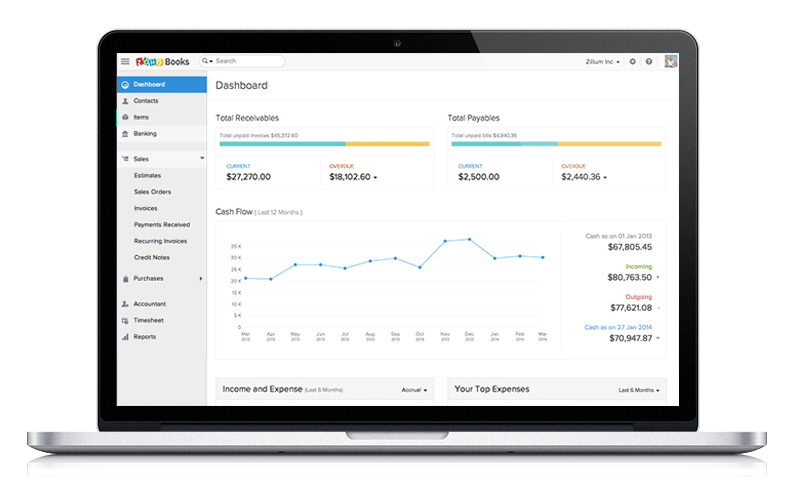

Tasks like invoicing are essential, basic functions to bring money into your business. Most businesses need an interface to create invoices either through email or by post. Being able to tally income and track expenses as well as generating reports based on that information is valuable to your company and helps you make more informed decisions. Another basic, but key function would be client and vendor administration. Being able to pull up the histories between you and your clients with a click of a button means ease of use and less filing cabinets.

2. Automation

If your calendar isn’t flooded with day to day tasks and making personal calls to your clients is something you pride yourself in, automation might not be a necessity. However, if you have multiple projects happening at once, automation of invoicing, late notices, recurring payments, deposits, etc. is a godsend. Keep your credit on track by paying your bills automatically. Knowing when to cut off services by keeping track of who hasn’t paid yet can be a money and time saver. Automation is essential to time-management for any business.

3. Tax Preparation

This feature makes you and your accountant’s life WAY easier at the end of the year. You can automate tax calculations at different tax rates and easily transfer data to your accountant. Having an expense report, or any large purchase deductions at the ready equals time savings not tallying up your shoebox of receipts at the end of the year.

These are the major three you want to consider when making an accounting software purchase. Lots of programs offer free trials, so you have a chance to try out the interface. If your business has already blossomed, there are a few more features to assess.

4. Quotes and Estimates

Some software allows you to generate templates on which to create quotes for potential clients, then automatically convert them to invoices.

5. Payroll Processing

Calculating time sheets is time consuming. With a payroll processing feature you can calculate hours, rate of pay and print checks.

6. Third-party and mobile input.

If you want to be able to access and input data from anywhere you are, this is an important feature. Automatically input data from your phone using a mobile version of your software or integrating a third party app such as a mileage tracker or device such as a POS system.

There are multiple solutions for your business accounting needs, the trick is finding the option that works for you. Remember, its all about ease of use and time saving. The software with the most bells and whistles can sometimes take up more of your time figuring out. Pick the software within the scope of your business and it is likely to be as straighfoward as you.